고정 헤더 영역

상세 컨텐츠

본문

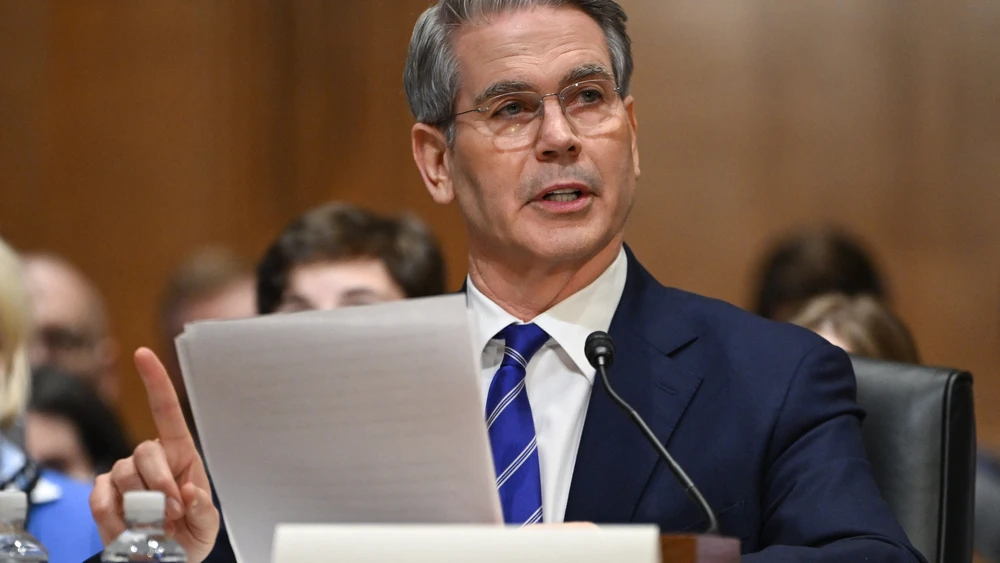

The Senate confirmation hearing for Scott Besent, nominated as Treasury Secretary for Trump’s second term, has drawn significant attention. As Besent laid out his economic strategies, including his views on tariffs, investors are evaluating the potential market implications. This article explores Besent’s policies and their impact on global markets, offering strategic investment guidance.

Key Highlights from Besent’s Hearing

- Besent criticised the longstanding tolerance of unfair trade practices, emphasising the need for tariffs as a negotiation tool.

- He argued that sanctions have limits due to the weakening role of the dollar as the global reserve currency and expressed a preference for tariffs.

- Besent committed to enforcing China’s trade agreement obligations, including purchase commitments.

- He supported the Federal Reserve’s independence, stating it must make impartial decisions.

- Besent reassured that under his tenure, the US would not face a debt default scenario.

- As a pragmatic global investor, Besent’s past roles include working at Soros Fund and founding Key Square Group in 2015.

- He previously proposed a plan for gradual tariff implementation immediately after the election.

Potential Economic Impacts

Trade Relations and Tariffs

- China: Besent’s focus on ensuring China’s compliance with trade agreements signals a potentially tense trade relationship. Gradual tariffs could place pressure on Chinese exports while giving businesses time to adapt.

- Global Trade: Increased tariffs might disrupt supply chains, raising costs for businesses and consumers worldwide.

Currency and Monetary Policy

- Besent’s comments on the dollar’s reserve currency status highlight the risk of over-reliance on sanctions. Tariffs may further strain global confidence in the dollar.

- His endorsement of the Federal Reserve’s independence could reassure markets, but tighter monetary policy may exacerbate volatility.

Strategic Investment Guide

Sectors to Watch

- Domestic Manufacturing: Tariffs may boost local production, making this sector a potential growth area.

- Technology and Consumer Goods: These sectors, heavily reliant on international supply chains, may face headwinds.

- Energy: Besent’s pragmatic approach could create opportunities in both traditional and renewable energy sectors.

Risk Management

- Geopolitical Monitoring: Keep an eye on US-China relations, as further trade tensions could destabilise global markets.

- Currency Hedging: Protect investments against dollar volatility through hedging strategies or diversification into other currencies.

Portfolio Allocation Recommendations

- Local Growth Sectors: Allocate 30–40% to sectors likely to benefit from tariff-driven demand for domestic goods.

- Global Diversification: Dedicate 30% to international equities to balance risks from US-centric policies.

- Liquid and Safe-Haven Assets: Maintain 20–30% in bonds, gold, or cash to navigate periods of uncertainty.

Conclusion

Scott Besent’s nomination as Treasury Secretary introduces a mix of risks and opportunities for investors. His emphasis on tariffs and pragmatic policy approach may reshape trade and economic landscapes. By staying informed and adopting a diversified, risk-aware investment strategy, investors can position themselves to benefit from these shifts while minimising potential downsides.

'경제' 카테고리의 다른 글

| 대만 침공: 글로벌 위기 속 투자 전략 가이드 (0) | 2025.01.17 |

|---|---|

| 베센트의 관세 폭탄: 투자 리스크와 기회 탐색 (0) | 2025.01.17 |

| The "Chainsaw President": Argentina's Economic Reforms and Investment Opportunities (0) | 2025.01.15 |

| 전기톱 대통령: 아르헨티나 경제 개혁과 투자 기회 (0) | 2025.01.15 |

| 멕시코 플랜: 투자 기회를 위한 새로운 경제 비전 (0) | 2025.01.15 |